VA Home Loans: Exclusive Advantages for Veterans and Active Service Solution Members

VA Home Loans: Exclusive Advantages for Veterans and Active Service Solution Members

Blog Article

Taking Full Advantage Of the Conveniences of Home Loans: A Detailed Strategy to Protecting Your Suitable Property

Browsing the complex landscape of home finances needs a methodical strategy to ensure that you secure the residential or commercial property that lines up with your monetary goals. To truly maximize the advantages of home loans, one need to consider what actions follow this foundational work.

Recognizing Home Mortgage Fundamentals

Comprehending the principles of mortgage is essential for anyone taking into consideration buying a building. A mortgage, usually described as a home loan, is a financial item that enables individuals to obtain cash to purchase real estate. The consumer accepts pay back the car loan over a specified term, generally varying from 15 to thirty years, with interest.

Trick parts of home mortgage include the major amount, rate of interest, and payment schedules. The principal is the quantity borrowed, while the rate of interest is the cost of loaning that amount, shared as a percentage. Rate of interest can be dealt with, continuing to be continuous throughout the car loan term, or variable, fluctuating based upon market problems.

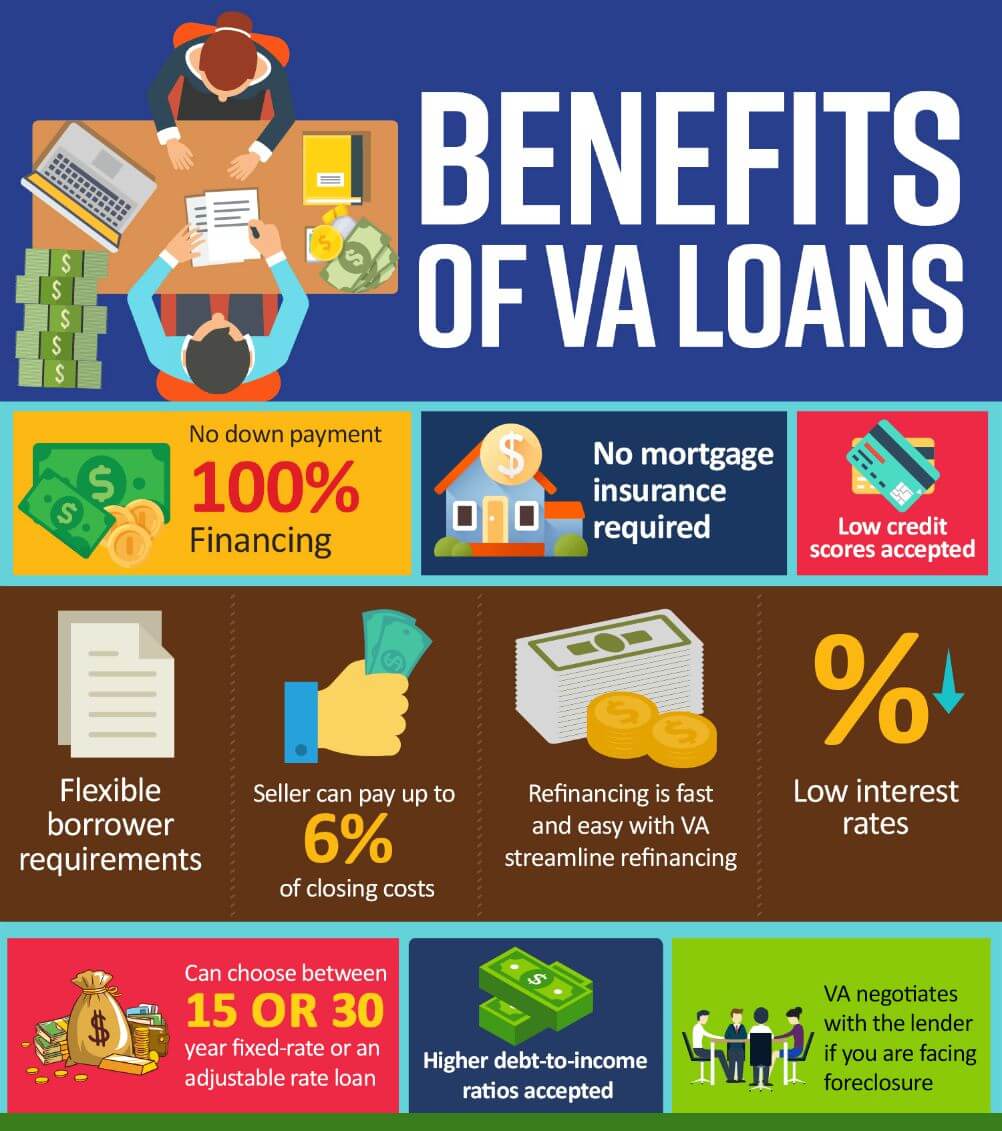

Furthermore, customers should know numerous types of home mortgage, such as traditional car loans, FHA lendings, and VA finances, each with distinct eligibility requirements and advantages. Comprehending terms such as down payment, loan-to-value ratio, and personal home mortgage insurance (PMI) is likewise vital for making informed decisions. By comprehending these essentials, prospective property owners can navigate the intricacies of the home mortgage market and identify options that line up with their monetary goals and home ambitions.

Analyzing Your Financial Situation

Assessing your financial situation is a critical action prior to getting started on the home-buying trip. Next, listing all regular monthly costs, making sure to account for repaired costs like rental fee, utilities, and variable expenses such as grocery stores and amusement.

After developing your income and expenditures, identify your debt-to-income (DTI) proportion, which is essential for lenders. This proportion is determined by dividing your overall monthly financial debt repayments by your gross monthly revenue. A DTI ratio listed below 36% is generally taken into consideration positive, suggesting that you are not over-leveraged.

Additionally, analyze your credit rating, as it plays a critical duty in protecting favorable finance terms. A higher debt score can cause reduced rates of interest, eventually conserving you cash over the life of the funding.

/mortgagemarvel/VA_Mortgage_Home_Loans_Florida_Tampa_Clearwater_Macdill_AFB_Wesley_Chapel_Riverview_South_Tampa_Hyde_Park__Unconventional_lending_Derek_Bissen-s7a34.jpg)

Exploring Car Loan Choices

With a clear picture of your economic scenario developed, the following action includes checking out the various funding choices offered to potential property owners. Comprehending the different sorts of home finances is critical in picking the ideal one for your requirements.

Traditional loans are traditional funding approaches that normally need a higher credit history and deposit however offer affordable rate of interest. Conversely, government-backed loans, such as FHA, VA, and USDA lendings, satisfy certain groups and often need reduced down settlements and credit history, making them accessible for novice buyers or those with limited funds.

One more alternative is variable-rate mortgages (ARMs), which feature reduced preliminary rates that change after a specified duration, potentially bring about considerable savings. Fixed-rate home mortgages, on the other hand, give stability with a regular rate of interest throughout the financing term, securing you versus market changes.

In addition, think about the financing term, which typically varies from 15 to thirty years. Much shorter terms may have greater month-to-month payments yet can save you rate of interest with time. By thoroughly reviewing these options, you can make an educated choice that aligns with your monetary objectives and homeownership aspirations.

Getting Ready For the Application

Efficiently preparing for the application procedure is essential for securing a home finance. This stage prepares for getting desirable financing terms and makes sure a smoother approval experience. Begin by evaluating your monetary circumstance, that includes evaluating your credit scores rating, revenue, and existing financial obligation. A solid credit rating is critical, as it affects the loan amount and rate of interest offered to you.

Following, collect needed paperwork. Typical demands include current pay stubs, tax returns, bank declarations, and evidence of possessions. Organizing these papers ahead of time can considerably speed up the application process. In addition, think about acquiring a pre-approval from loan providers. When making an offer on a property., this not just offers a clear understanding of your borrowing ability yet likewise strengthens your placement.

In addition, identify your spending plan by considering not just the lending quantity yet likewise real estate tax, insurance coverage, and maintenance expenses. Familiarize on your own with numerous funding kinds and their respective terms, as this expertise will equip you to make enlightened choices during the application process. By taking these positive actions, you will improve your preparedness and raise your chances of securing the home mortgage that finest fits your demands.

Closing the Bargain

During the closing meeting, you will certainly examine and sign numerous papers, such as the funding quote, shutting disclosure, and home loan arrangement. It is vital to extensively understand these records, as they outline the funding terms, settlement schedule, and closing costs. Take the time to ask your lender or realty representative any kind of concerns you might have to stay clear of misconceptions.

Once all files are signed and funds are transferred, you will get the keys to your new home. Remember, shutting prices can differ, so be gotten ready for expenditures that may include assessment charges, title insurance, and lawyer costs - VA Home Loans. By staying arranged and educated throughout this process, you can make sure a smooth transition right into homeownership, making best use of the benefits of your mortgage

Conclusion

To conclude, taking full advantage of the advantages of home mortgage necessitates a methodical strategy, encompassing an extensive analysis of financial scenarios, expedition of varied lending choices, and careful prep work for the application process. By adhering to these steps, potential house owners can boost their opportunities of securing favorable financing and accomplishing their property possession objectives. Ultimately, careful navigating of the closing process further solidifies a successful transition into homeownership, ensuring long-term financial stability and fulfillment.

Browsing the complicated landscape of home fundings needs a methodical method to make sure that you safeguard the building that straightens with your monetary goals.Understanding the fundamentals of home finances is crucial for any person taking into consideration acquiring a residential or commercial property - VA Home Loans. visit this site A home lending, frequently referred to as a home loan, is a financial item that permits individuals to borrow cash to purchase actual estate.In addition, debtors ought to be aware of numerous types of home lendings, such as standard fundings, FHA car loans, and VA car loans, each with distinctive qualification criteria and advantages.In conclusion, maximizing the advantages of home fundings necessitates a systematic technique, encompassing a detailed analysis of financial scenarios, exploration of diverse loan choices, and meticulous preparation for the application procedure

Report this page